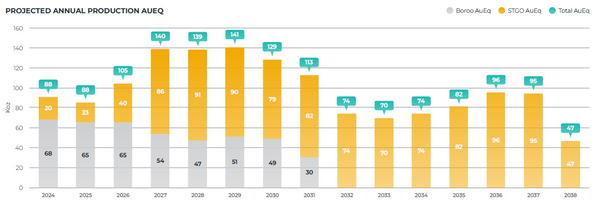

DALLAS, TX -- December 5th, 2024 -- Steppe Gold Ltd. (TSX:STGO): Stonegate Capital Partners Updates Coverage on Steppe Gold Ltd. (TSX:STGO). In April of 2024 the Company announced an agreement to acquire Boroo Gold from Boroo Singapore with closing announced on August 1, 2024, bringing the Boroo Mine located in Mongolia under the Steppe umbrella and creating the leading gold producer in Country. The Boroo Mine currently produces approximately 65Koz to 70Koz of gold per year with an expected 430Koz production to 2031. The combined companies are expected to produce 80Koz to 85Koz in 2024 and 2025. Per the most recent technical report the Boroo Mine has an NPV of $260.1M using a discount rate of 7.5% and a gold price of $2,300 per ounce. We note that this gold price per ounce is significantly than current spot prices giving upside to the last stated NPV. We note that the Boroo mine has produced ~57,244oz as of 3Q24. The immediate cash flows from the acquisition provide additional financial flexibility. Additional cost savings and synergies are anticipated as Steppe and Boroo integrate their operations. The Company is already seeing strong revenue growth in 2H24 from this acquisition.

Tres Cruces Sale: In April of 2024 the Company announced another transaction with Boroo Singapore to sell the Tres Cruces Project for approximately CAD$12.0M, which also closed on August 1, 2024. This will be in the form of cash payments over 18 months from the closing date. We note that this brings Steppe’s focus back to Mongolia and provides additional liquidity into the company.

ATO Continues Production: Steppe Gold’s flagship project is the ATO Gold Mine, with Phase 1 fully constructed and commenced producing gold and silver in the Spring of 2020. For 3Q24, the Company mined 62,181 tonnes of ore, with 125,898 tonnes stacked at an average grade of 0.56g/t.

ATO Expansion In Progress: Steppe is currently expanding their core asset. The technical report estimates after-tax NPV5% of US$242M, an IRR of 67%, and a payback in 3 years with the assumption of $1,700 per ounce gold, $20 per ounce of silver zinc price of $2,500/t, and lead price of $1,970/t. Production in phase 2 is expected to start in 1Q26, with the first $50M tranche drawn from the fully funded $150M finance package to accelerate the construction and development of Phase 2 Expansion. When adjusted for a more current gold price of $2,300 per ounce and an NPV rate of 7.5%, the ATO project shows an NPV of $422.6M. Management has indicated additional updates will be provided in the near future.

Valuation: When valuing STGO we apply a EV/NAV range of 0.60x to 0.80x which results in a valuation of $0.47 to $0.81 with a midpoint of $0.64. When using an EV/Reserves valuation method we apply a multiple range of 120x to 140x, which results in a valuation range of $0.56 to $0.75 with a midpoint of $0.66. We believe these valuation ranges bring STGO closer to comparable companies.