DALLAS, TX -- November 8th, 2024 -- OppFi, Inc. (NYSE: OPFI) : Stonegate Capital Partners Updates Coverage on OppFi (NYSE: OPFI). OppFi reported revenue, adj. Net Income, and adj. EPS of $136.6M, $31.5M, and $0.36, respectively. This compares to our/consensus estimates of $130.1M/$130.8M, $17.9M/$17.2M, and $0.21/$0.20.Net revenue margin was 66.7% for the quarter, which was a year over year margin expansion of 992 bps from 3Q23. The impressive performance this quarter is attributed to a notable increase in both total revenue and net income, setting new records for the Company. We expect this positive trajectory to persist throughout the remainder of 2024, as OppFi continues to prioritize strategic initiatives aimed at enhancing profitability and driving sustainable growth.

Company Updates:

Liquidity and Balance Sheet: OPFI concluded the third quarter with $74.2M in cash and restricted cash, a slight increase of $0.3M from the end of 2023. The Company also had $199.4M in unused debt capacity, which, combined with $44.8M of unrestricted cash, totaled $273.6M in liquidity. This strong liquidity position provides significant flexibility, enabling The Company to potentially return value to shareholders through dividends, share repurchases, and funding for both external and organic growth initiatives. Notably, OPFI repurchased $1.0M worth of Class A common stock during the third quarter.

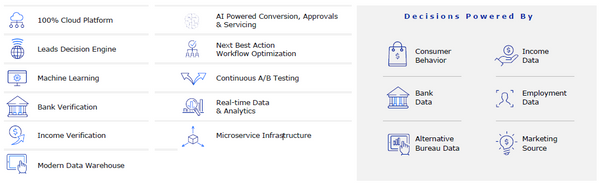

Originations: Total net originations for the third quarter were $218.8M, an increase from $205.5M in the previous quarter and $195.7M in the same quarter last year. Originations typically follow seasonal trends, and we anticipate continued year-over-year improvement. In this quarter, 100% of originations were facilitated by bank partners. The auto-approval rate rose to 77%, up from 76% last quarter and 72% in the same quarter last year. This resulted in ending receivables of $413.7M. We note that OPFI has successfully increased originations without raising acquisition costs.

Lending Standards: Charge-offs as a percentage of total revenue decreased to 34.3% by the end of the third quarter, down from 42% in the same quarter last year. This demonstrates the company’s capability to increase revenues while effectively managing credit quality. We anticipate that OPFI will continue to target the lowest risk segments, especially as upmarket banks tighten their credit standards. Additionally, we remain vigilant about the potential impacts of inflation, federal interest rates, and unemployment on OPFI’s customer base.

Guidance: In 3Q24, OPFI reiterated its full-year revenue guidance and raised both the adjusted net income and adjusted EPS guidance for FY24. Revenue guidance is maintained at a range of $510M to $530M. Adjusted net income guidance was raised to a range of $74M to $76M, up from the previous range of $63M to $65M. Adjusted EPS guidance was increased to a range of $0.85 to $0.87, from the previous range of $0.73 to $0.75. We believe the company is well-positioned to meet and exceed its guidance. We have adjusted our model accordingly.

Valuation: We use a P/E comp analysis to guide our valuation. Our valuation relies on a P/E multiple range of 7.0x to 8.0x with a midpoint of 7.5x This arrives at a valuation range of $6.49 to $7.41 with a mid-point of $6.95.