DALLAS, TX -- November 5th, 2024 -- Gladstone Commercial Corporation.(NasdaqGS: GOOD): Stonegate Capital Partners Updates Coverage on Gladstone Commercial Corp. (NasdaqGS: GOOD). Gladstone Commercial Corp. reported revenue, FFO per share, and AFFO per share of $39.2M, $0.38, and $0.14, respectively. This compares to our/consensus estimates of $36.8M/$36.9M, $0.36/$0.35, and $0.31/$0.28. Core FFO for the quarter was $0.38 per share, up from $0.36 in 2Q24. This sequential increase was primarily driven by a $2.0M settlement received at one property related to deferred maintenance.

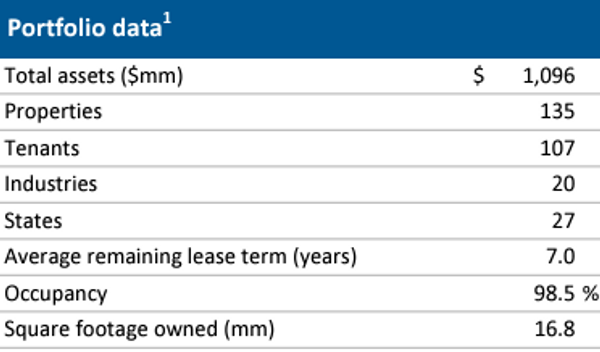

Transactions: In the third quarter of 2024, Gladstone Commercial Corp. continued to demonstrate strong financial performance. The Company's portfolio now includes 135 properties, a slight decrease from 136 at the end of 2Q24, reflecting its strategic capital recycling program. During 3Q24, GOOD sold two non-core properties for an aggregate of $14.2M and acquired one fully occupied, 50,102 square foot property for $10.2M at a cap rate of 9.94%. This acquisition aligns with the company’s focus on high-growth industrial properties. Despite ongoing economic uncertainty, GOOD expects steady access to debt and equity markets, with rents rising and a continued focus on industrial properties and active portfolio management.

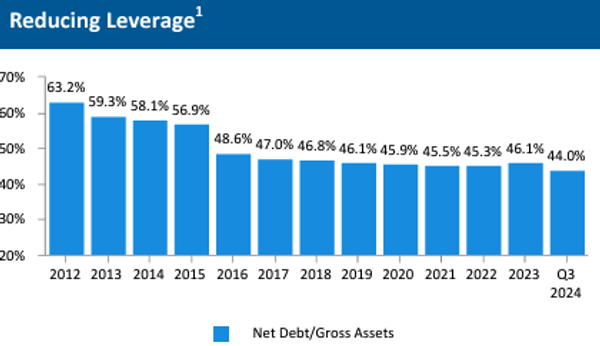

Strengthened Liquidity and Capital Resources: In the third quarter, Gladstone Commercial Corp. reported a solid liquidity position, enhancing its financial flexibility. GOOD reported $80.7M in liquidity, which includes $10.5M in cash and cash equivalents, and a revolver borrowing capacity of $70.2M. The reported figures above all reflect sequential growth from the previous quarter. Lastly, The Company’s strategic utilization of both equity and debt continues to support its ongoing investments and ensures the fulfillment of both short-term and long-term financial objectives.

Fundamentals Remain Strong: GOOD continues to demonstrate strong fundamentals. At the end of 3Q24, occupancy remained high at 98.5%, with 100% collection-maintained quarter-over-quarter rent. The portfolio’s weighed average lease term was 7.0 years, consistent with the previous quarter. This stability is attributed to the renewal or leasing of 242,467 square feet across five properties, with remaining lease terms ranging from 6.1 to 8.9 years.

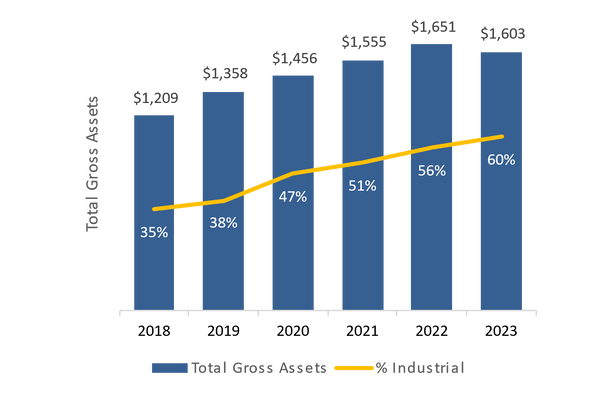

Improving Diversification: GOOD continues to pivot from office properties into industrial. As of 3Q24, The Company’s portfolio, as a function of straight-line rent, comprised 63% industrial properties and 33% office properties. This marks a change from 62% industrial and 34% office in 2Q24. This transition is even more pronounced since 2019 when the Company ended the year with 38% industrial and 57% office. We are encouraged by the continued growth in the Company’s industrial portfolio.

Payout Ratios: The Company currently pays a 7.5% dividend yield, down from 8.3% in 2Q24. This relates to paying out an annualized $1.20 per share, which is a reduction from the $1.50 per share paid out in FY22. As is noted in the valuation segment, despite the decreased dividend the company still appears undervalued. Based on a 3Q24 per share values for FFO of $0.38, Core FFO of $0.38, and AFFO of $0.33 GOOD has payout ratios of 80%, 80%, and 219% respectively.

Valuation: We use a combination of comp analysis, Revalued Net Asset Value per share analysis, and a Perpetual Growth Model based on the most recent FFO Payout Ratio to frame our valuation of GOOD. When we average these valuation methods it returns a valuation range of $15.12 to $17.33 with a mid-point of $16.22.