𝐃𝐀𝐋𝐋𝐀𝐒, 𝐓𝐗 -- 𝐀𝐮𝐠𝐮𝐬𝐭 8𝐭𝐡, 𝟐𝟎𝟐𝟒 -- OppFi, Inc. (NYSE: OPFI) : Stonegate Capital Partners Updates Coverage on OppFi (NYSE: OPFI).

Company Updates:

Financial Results: OPFI reported revenue, adj. Net Income, and adj. EPS of $126.3M, $24.8M, and $0.29, respectively. This compares to our/consensus estimates of $124.8M/$124.0M, $11.6M/$12.9M, and $0.13/$0.15. Net revenue margin was 68.3% for the quarter, which was a year over year margin expansion of 743bps from 2Q23. These strong results are driven by both an expansion of revenues as well as an expansion in gross profit margin. We anticipate that this trend will continue through the balance of 2024 as OPFI focuses on profitability and growth.

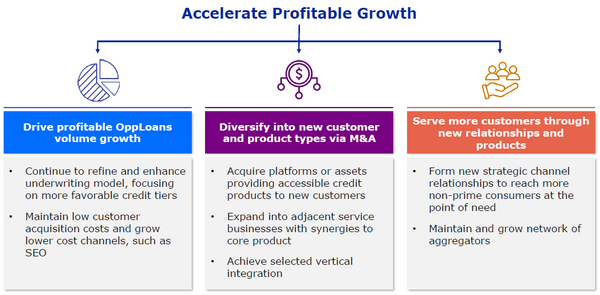

Growth Through Acquisition: On August 1, 2024, the Company announced a strategic acquisition of a 35% equity interest in Bitty Advance (“Bitty”) for $17.9M, which is a 6.0x valuation based on Bitty’s $8.5M TTM adj. net income as of 1Q24. This transaction was financed with 85% cash and 15% stock. Bitty is a profitable and growing platform that provides credit access to underserved small businesses, many of which have difficulty accessing traditional bank loans. We view this transaction as strategically beneficial as it opens the small business financing vertical for OPFI.

Originations: Total net originations for the quarter were $205.5M, which is up from the $163.5M posted last quarter and up from ~$200.7M in 2Q23. We note that originations tend to follow seasonal trends. We expect originations to continue to improve year over year. Of the originations in the quarter 55.6% were to existing customers with the remaining 44.4% to new customers. Auto approval rate for the quarter was 76%, which was up from last quarter and 2Q23 at 73% and 72%, respectively. This resulted in ending receivables of $387M. We note that OPFI has been able to grow originations without increasing acquisitions costs.

Lending Standards: Charge-offs as a percentage of total revenue stood at 44% to end the quarter, which is down from 47% at the end of 2Q23. We view this as proof of the Company’s ability to simultaneously grow revenues and manage credit quality. We expect OPFI to continue focusing on the lowest risk segment as upmarket banks tighten credit standards. We also remain focused on the impacts of inflation, fed rates, and unemployment on the Company’s customers.

Guidance: OPFI has reiterated its full-year revenue guidance and raised both the adj. net income and adj. EPS guidance for FY24. Revenue guidance is maintained at a range of $510.0M to $530.0M, which implies y/y revenue growth of 2.2% at the midpoint. Adj. NI guidance was raised to a range of $63.0M to $65.0M, which implies y/y growth of 49.6% at the midpoint, up from a range of $50.0M to $54.0M. Adj. EPS guidance was raised to a range of $0.73 to $0.75, which implies y/y growth of 47.2% at the midpoint, up from a range of $0.58 to $0.62. We believe the Company is positioned to meet and exceed its guidance. We have adjusted our model accordingly.

Valuation: We use a P/E comp analysis to guide our valuation. Our valuation relies on a P/E multiple range of 6.0x to 7.0x with a midpoint of 6.5x This arrives at a valuation range of $5.18 to $6.04 with a mid-point of $5.61.