DALLAS, TX -- April 30, 2018 -- Stonegate Capital Partners has initiated research coverage on Immunovaccine, Inc. (TSX:IMV) (OTCQX:IMMVF). Despite ongoing advancements in the development of cancer treatment, pharmaceutical developers are still facing challenges involved with delivering therapeutics to targeted cells with the most effective payload while minimizing side effects and resistance issues. Immunovaccine believes that immunotherapy based on its proprietary drug delivery platform has the potential to revolutionize treatment in cancer as well as other areas.

"With promising clinical data for its lead product candidate, DPX – Survivac, and numerous indications likely to quickly follow an initial approval, our valuation analysis for the Company’s most advanced asset results in an estimated range of approximately $3.00 to $4.00 per share," said Laura S. Engel, CPA Senior Research Analyst at Stonegate Capital Partners.

The Company’s unique and proprietary DepoVax™ platform brings to the table a novel mechanism of action, enabling in vivo engineering of cancer-targeted killer T cells, offering a highly differentiated alternative to previous drug delivery technologies such as CAR-Ts.

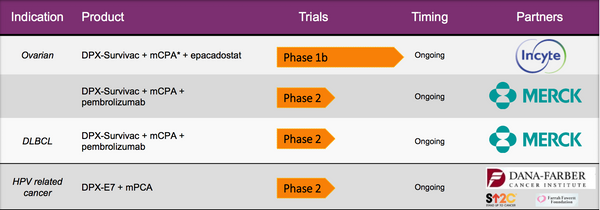

DPX – Survivac is the Company’s lead product candidate utilizing a proprietary cancer target with Survivin-based antigens to treat ovarian cancer and diffuse large B-cell lymphoma (DLBCL); this asset has received orphan designation in both the US and EU and is currently part of two Phase 2 trials as well as one Phase 1b.

The Company’s initial target markets are sizable; with cancer being the #2 cause of deaths worldwide, the potential for immuno-oncology is significant; the global immunotherapy drugs market is projected to reach over $200 billion (USD) by 2021, up from just over $100 billion in 2016, or a CAGR of 13.5%.

Recent results include a net loss of ($12.0M) for the year ended 2017 vs. ($8.9M) for the prior year. Operating expenses for 2017 increased Y-O-Y, most affected by additional R&D expense, slightly elevated G&A, and additional investment in business development and investor relation efforts. Management states that cash on hand (~$15M at year-end plus ~$14M from subsequent raise) is sufficient to fund its business plan well into 2019.

Stonegate Capital Partners is a Dallas-based corporate advisory firm dedicated to serving the specialized needs of small-cap public companies. Since our inception, our mission has been to find innovative, undervalued public companies for our network of leading institutional investors who seek high-quality investment opportunities.

###

SOURCE: Stonegate Capital Partners