DALLAS, TX -- November 14th, 2024 -- EnSilica PLC (AIM: ENSI): Stonegate Capital Partners initiates their coverage on EnSilica PLC (AIM: ENSI).

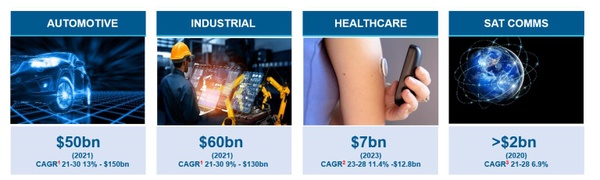

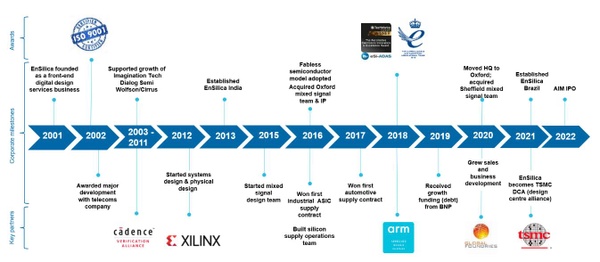

In 2H24, EnSilica PLC continued to build on its strategic initiatives and market strengths, achieving significant milestones. The Company's strong position and intellectual property in automotive, industrial, healthcare, and satellite connectivity applications for mixed-signal ASICs continue to provide a competitive edge. We believe that ENSI is well positioned to capitalize on the global ASIC market, which is projected to reach $25.0B by 2030. EnSilica is well-positioned to benefit from this expansion, particularly in high-demand sectors such as telecommunications, automotive, industrial, and aerospace. EnSilica pursued expansion through consolidation and vertical integration, enhancing its market position and comprehensive service offerings. The successful completion of equity fundraisings totaling £6.5M and the refinancing of external loans with a £6.0M facility further strengthened its financial foundation, enabling continued investment in intellectual property and operational capabilities.

Company Updates

Financial Results: ENSI reported revenue, adj EBITDA, and Net Income of £15.8M, £1.2M, and (£0.7), respectively. In the second half of FY24, ENSI reported a 23% increase in revenues to £25.3M, up from £20.5M year over year. This growth was driven by strong customer demand and strategic investments in intellectual property, ASIC NRE, and team development. EBITDA increased slightly to £1.7M from £1.6M in the previous year, despite ongoing investments in scaling operations. Cash and cash equivalents rose to £5.2M as of May 2024, up from £3.1M at the end of FY23.

Outlook Remains Positive: EnSilica’s outlook for FY25 is promising, with the company starting the year strong by achieving key milestones and securing new business across its target sectors. Continued investments in research and development, along with partnerships with industry leaders like TSMC, enhance its competitive edge. The Company’s strong financial foundation, supported by recent equity fundraising and loan refinancing, ensures that it is well-prepared to sustain growth. With this the Company is guiding to FY25 revenue of ~£30.0M and EBTIDA of ~£5.0M.

Contract Momentum: ENSI demonstrated strong contract momentum in FY24, securing high-value contracts across various sectors, including a £2.5M satellite broadband chip contract, a €3.8M automotive and industrial chip contract, and a $30M telecommunications ASIC contract. The Company also achieved significant milestones in Edge AI with a $7.0M supply-only contract and in factory automation with a $2.4M contract with Siemens. Additionally, EnSilica’s partnerships and strategic investments, such as joining the TSMC Design Centre Alliance, have bolstered its market position. Post year-end, EnSilica signed new contracts with a lifetime expected value of $65.0M, further underscoring The Company’s robust market positioning.

Valuation: We use a P/E Model, DCF Model and EV/EBITDA comp analysis to guide our valuation. Our P/E model results in a valuation range of £0.89 to £1.04 with a mid-point of £0.97. Our DCF analysis produces a valuation range of £0.80 to £0.96 with a mid-point of £0.88. Our EV/EBITDA valuation results in a range of £0.80 to £0.93 with a mid-point of £0.87. When taken together our valuation ranges average at £0.83 to £0.98 with a mid-point of £0.90.